Bar the Bull

Dormant account

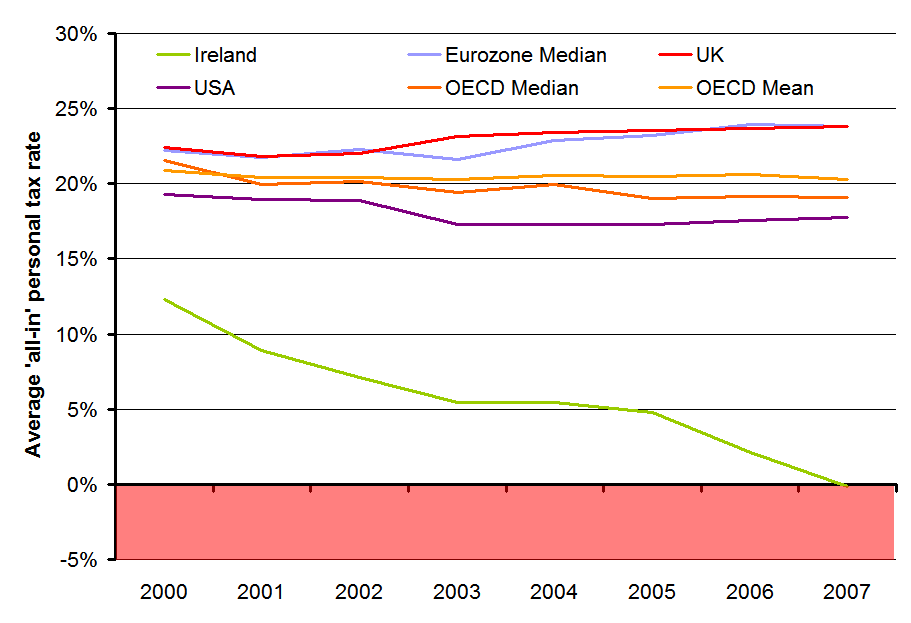

It is all tax (excluding and including social security). So it includes VAT, capital and corporate tax. The percentages given are as a percentage of GDP

In fairness to Ireland, these figures probably underestimated the tax burden we faced in 2007. Because GDP overstated Irish economic activity, as it includes profits of multinational corporations in Ireland. And because such taxes are taxed at 12.5%.

However, since we have stopped buying houses, our capital tax take (which was much more punitive than other countries) would be a lot lower now.

All in all, our problems were because we borrowed too much money.

In fairness to Ireland, these figures probably underestimated the tax burden we faced in 2007. Because GDP overstated Irish economic activity, as it includes profits of multinational corporations in Ireland. And because such taxes are taxed at 12.5%.

However, since we have stopped buying houses, our capital tax take (which was much more punitive than other countries) would be a lot lower now.

All in all, our problems were because we borrowed too much money.